OPINION ANALYSIS

Court rules federal immunity law does not shield Turkish bank from U.S. prosecution

on Apr 20, 2023 at 9:29 am

The Supreme Court on Wednesday ruled that a Turkish bank can be prosecuted in U.S. courts for its role in a conspiracy to evade U.S. sanctions on Iran. The justices rejected the bank’s contention that because the Turkish government owns a majority share of the bank, known as Halkbank, it is immune from prosecution under a federal law that generally prohibits lawsuits against foreign governments in U.S. courts. But the court left the door open for the bank to press a different immunity argument in the lower courts.

Federal prosecutors in New York indicted the bank in 2019 on charges that it had participated in a multi-year scheme to launder billions of dollars stemming from the sales of Iranian oil and natural gas, in violation of U.S. sanctions on Iran. The bank denies the allegations, but it also argued that the charges should be dropped because the Foreign Sovereign Immunities Act’s general bar on lawsuits against foreign governments also forbids criminal prosecutions.

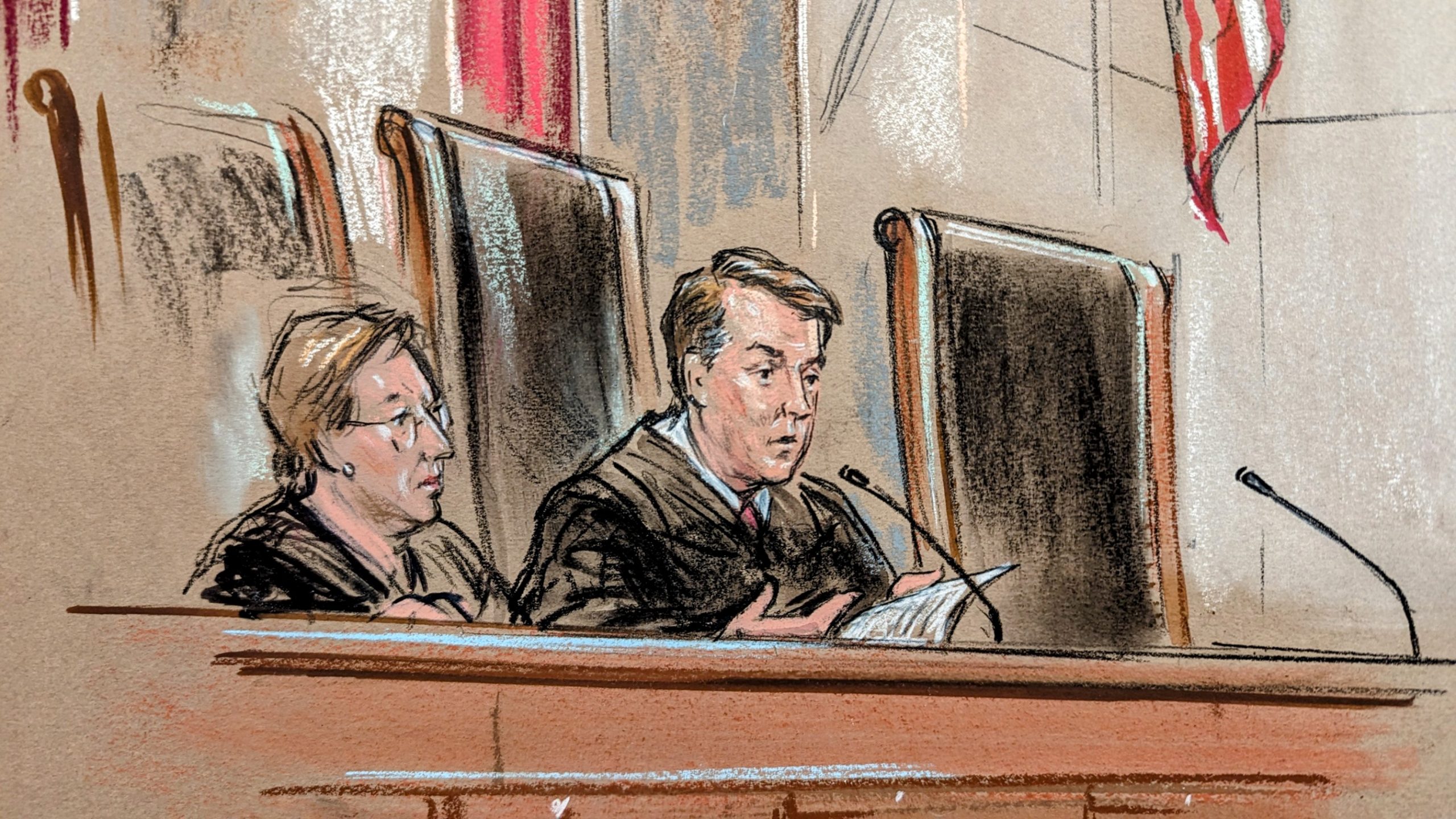

In an opinion by Justice Brett Kavanaugh, the justices rebuffed that argument. As an initial matter, Kavanaugh agreed that the New York federal court has jurisdiction over the criminal prosecution of the bank under a federal law that gives federal district courts the power to hear all criminal cases involving “offenses against the laws of the United States.” That language, Kavanaugh concluded, is “sweeping” and “plainly encompasses” the charges against the bank, even if Congress did not clearly state that the law was intended to apply to foreign governments and their related entities.

The FSIA also does not shield the bank from criminal prosecutions, Kavanaugh continued. That conclusion is clear from the text of the FSIA, which “indicates that the statute exclusively addresses civil suits against foreign states and their instrumentalities.” Indeed, Kavanaugh observed, the FSIA refers to a “civil action” and outlines procedures that would relate only to a civil action, such as for counterclaims, default judgments, and punitive damages. And although Congress would likely have said something if it wanted the FSIA to provide immunity from criminal prosecutions as well, Kavanaugh added, there is no reference at all to criminal proceedings.

“On Halkbank’s view, a purely commercial business that is directly and majority-owned by a foreign state could engage in criminal conduct affected U.S. citizens and threatening U.S. national security while facing no criminal accountability at all in U.S. courts. Nothing in the FSIA supports that result,” Kavanaugh emphasized.

The court left the bank one potential path to immunity, but it did not weigh in on whether the bank was likely to succeed. The bank contended that even if the FSIA did not shield it from criminal prosecution, it nonetheless had immunity under the common law – that is, judge-made law. But because the U.S. Court of Appeals for the 2nd Circuit “did not fully consider” this point, Kavanaugh said, the court sent the case back for the lower court to take a more complete look.

In a separate opinion joined by Justice Samuel Alito, Justice Neil Gorsuch agreed that the New York court has jurisdiction over the criminal prosecution of foreign sovereigns, but in his view the case is a “straightforward” one. The FSIA applies to both civil and criminal cases, and the bank would normally be entitled to immunity as a “foreign state,” because the Turkish government owns a majority share. However, Gorsuch continued, the federal government still can prosecute the bank under the FSIA’s exception for commercial activities.

Gorsuch disagreed with the majority’s decision to send the case back to the 2nd Circuit for another look at whether the bank is immune under the common law. That ruling, he said, “overcomplicates the law for no good reason” when the court could simply rely on the text of the FSIA to reach “the same straightforward conclusion the Second Circuit reached: This case against Halkbank may proceed.”

This article was originally published at Howe on the Court.