Justices rule IRS can summon bank information without notifying account holders under appropriate circumstances

Section 7609(a) of the Internal Revenue Code generally requires the Internal Revenue Service to notify anyone whose records have been summoned, at its behest, from a third party. Moreover, those individuals or entities must receive a copy of the summons and be informed of their right to bring a proceeding to quash it. There are, however, exceptions to the notice requirement. When the IRS issues a summons to a third party as part of its efforts to collect an assessed tax, it may do so without notice, even if the taxes have been assessed against someone other than the person whose records have been summoned.

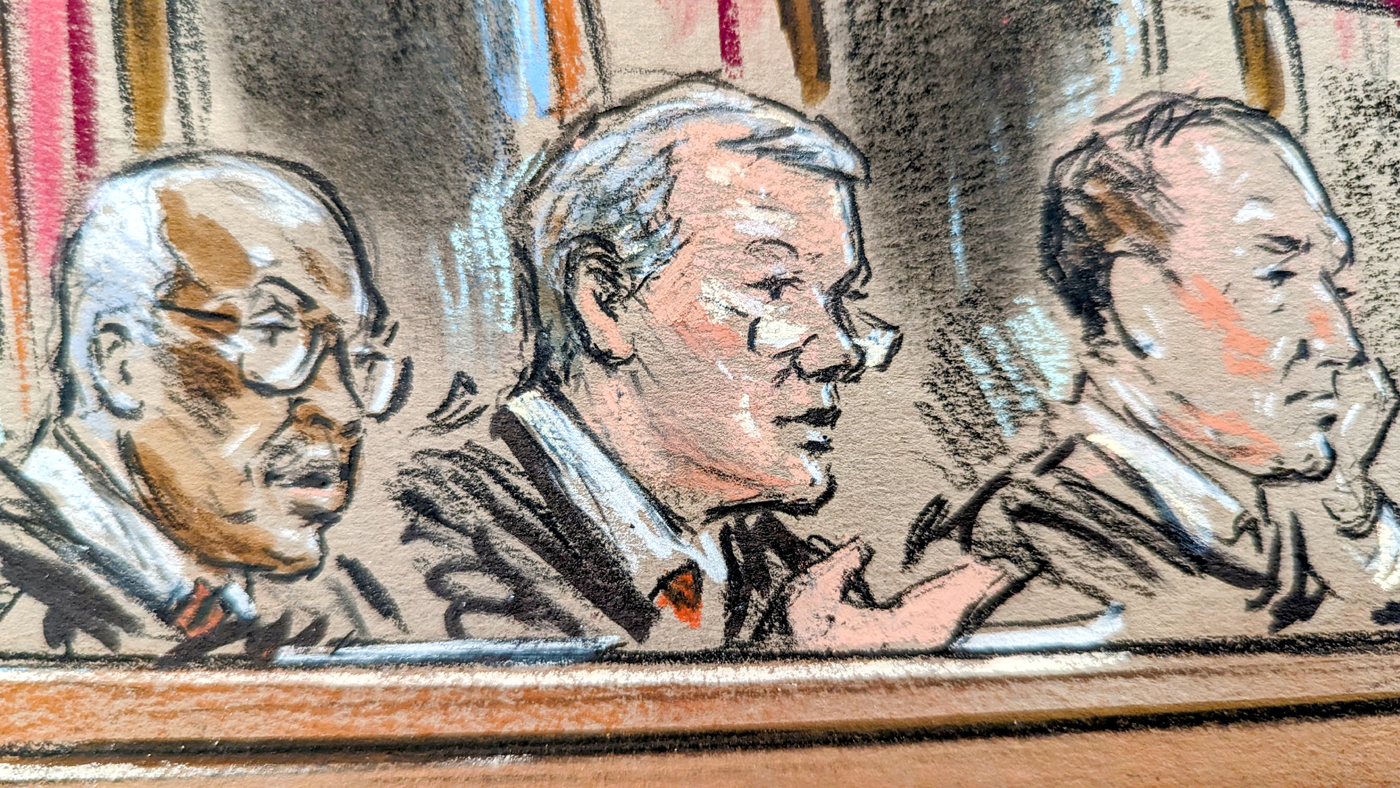

In Polselli v. Internal Revenue Service, a unanimous court confirmed that the IRS can issue such a summons without notice to the account holder. The plain language of the statute, the court found, does not require that the delinquent taxpayer have a legal interest in the records summoned by the IRS. Chief Justice John Roberts delivered the opinion of the court; Justice Ketanji Brown Jackson issued a concurring opinion, which Justice Neil Gorsuch joined.

The case began after Remo Polselli accumulated over $2 million in back taxes. The IRS suspected Polselli was shielding his assets and issued a series of administrative summonses to Wells Fargo, Bank of America and J.P. Morgan Chase, demanding records regarding the bank accounts of Polselli’s wife, Hanna, and his law firms. Having been notified by the banks, Hanna and the law firms attempted unsuccessfully to quash the summonses. The district court, and later the U.S. Court of Appeals for the 6th Circuit, concluded that the governing statutory provision, by its plain language, simply did not require the IRS to provide notice. Interpreting the same statutory language, both the U.S. Court of Appeals for the 7th and Circuit and the U.S. Court of Appeals for the 10th Circuit reached the same conclusion. By contrast, the U.S. Court of Appeals for the 9th Circuit was willing to excuse the relevant notice only if the delinquent taxpayer had some legal interest or title in the object of the summons. Thursday’s decision in Polselli resolved that conflict.

Declining to wrestle with the meaning of “in aid of the collection” of an assessed tax or whether implicit restraints necessarily exist, the court came to the rather humdrum conclusion that the plain language of the statute does not set forth a “legal interest” requirement. Noting that the statute excuses notice when issued “in aid of the collection of an assessment made or judgment rendered against the person with respect to whose liability the summons is issued,” the court simply pointed out that no “legal interest” requirement is articulated. The words are simply not there. In fact, the court proceeded to highlight language in Section 7610 (which distinguishes between contexts in which a taxpayer does or does not have a proprietary interest in property) before reasoning that the absence of such language in Section 7609 “suggests that Congress deliberately omitted a similar requirement with respect to the notice exception.”

The court then turned to the Polselli’s “legal interest” argument, which effectively posits that a summons can be “in aid of the collection” of an assessed tax only if the summons will yield collectible assets. Rejecting this argument, the court emphasized that even if summoned account records may not yield collectible assets, they may, in fact, “aid in” the eventual collection of the taxpayer’s deficiency.

The court also devoted attention to the recurring argument that a plain or “hyperliteral” reading of Section 7609(c)(2)(D)(i) renders Section 7609(c)(2)(D)(ii) superfluous, thereby necessitating a narrower reading of clause (i) (by adding a legal interest requirement) as a matter of sound statutory construction. Section 7609(c)(2)(D)(i) excuses notice with respect to a summons “issued in aid of the collection of an assessment made or judgment rendered against the person with respect to whose liability the summons is issued.” Section 7609(c)(2)(D)(ii) excuses notice with respect to a summons “issued in aid of the collection of … the liability at law or in equity of any transferee or fiduciary of any person referred to in [7609(c)(2)(D)(i)].” In the court’s view, each part of the statute performs a separate and distinct function. Clause (i) addresses collection in the wake of an assessment or judgment, whereas clause (ii) addresses collection upon the finding of a liability. A liability, noted the court, may arise before the making of an assessment, and the IRS may attempt collection before making a formal assessment, at least in some instances. The court also went on to emphasize that clause (i) of the statute concerns assessments or judgments against a taxpayer, whereas clause (ii) concerns the liability of a transferee orfiduciary. These differences, reasoned the court, allow clause (ii) to operate in contexts in which clause (i) cannot. Turning to the privacy concerns articulated by the petitioners, the court clarified that it was not dismissing such concerns but did not see them as justification for reading the statute narrowly.

In her concurring opinion, Jackson emphasized that by default, Section 7609 requires notice, thereby effectively balancing the interests of the IRS (in obtaining useful information promptly) and the taxpayers (empowering them to prevent IRS overreach). Readily acknowledging that a taxpayer may not be given an opportunity to thwart the IRS’s collection efforts, she nonetheless refused to accept the notion that “in the context of a default-notice system, Congress would intentionally insert an exception that could so dramatically upend its objectives.” In her view the statutory language cannot be read too broadly, and both judicial and administrative vigilance are in order.

Reliance on the plain language of Section 7609(c)(2)(D)(i) was ultimately the court’s best course of action here. Given that Section 7609(c)(2)(D)(ii) only applies to the transferee or fiduciary of a taxpayer already suffering assessment (or judgment), the court’s somersaulting effort to eradicate its superfluity does not land well. All may readily acknowledge that “in aid of execution” is not “limitless,” but the specific language of a proposed limiting standard is just as absent as “taxpayer legal interest” requirements, and sound judicial doctrines can enhance administrability and fairness. For taxpayers at least, reliance on pure textual compliance is a luxury they have rarely enjoyed.

Posted in Merits Cases

Cases: Polselli v. Internal Revenue Service