Money for safety-net hospitals at stake in dispute over Medicare payment formula

When it comes to highlighting the complexity of the Medicare Act and its hospital payment rules, Becerra v. Empire Health Foundation doesn’t disappoint. The case generates a whirlwind of interpretive complication as the parties spar over the proper application of a complex Medicare payment rule. But statutory interpretation isn’t the only issue at stake in Empire Health, which will be argued on Monday. The Chevron doctrine, a pillar of administrative law, also looms large in the case. That doctrine, first applied in 1984 in Chevron U.S.A. Inc. v. Natural Resources Defense Council, determines when a federal court must defer to an agency’s interpretation of a statute it administers.

The Chevron analysis involves two steps. First, under step one, if the court determines Congress’ intent is clear and unambiguous in the statute, the court will interpret the statute according to its terms, without deferring to the agency. However, if the statutory language is ambiguous, the court turns to step two. Under this step, a court will accept the agency’s interpretation if it is based on a permissible construction of the statute.

Since at least six justices either disfavor the doctrine or think it should be narrowed, Empire Health could also have lasting effects on Chevron.

The issue: Medicare payment for safety-net hospitals

At issue in Empire Health is how the Department of Health and Human Services, or HHS, calculates special Medicare payments to “disproportionate share hospitals,” or “DSH hospitals.” DSH hospitals serve a high percentage of low-income patients. The Medicare Act, which provides health insurance for the nation’s elderly and disabled, generally pays hospitals on a fixed-fee basis. Hospitals get a set dollar amount for each Medicare patient they treat, based on each patient’s diagnosis. But DSH hospitals get an upward payment adjustment to account for the increased cost of treating low-income patients, who are often in worse health and more costly to treat.

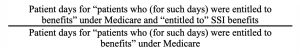

HHS calculates the upward payment adjustment for DSH hospitals based on the sum of two fractions, called the Medicare fraction and the Medicaid fraction, set out in 42 U.S.C. § 1395ww(d)(5)(F)(vi)(I) and (II). The Medicare and Medicaid fractions each represent a separate measure of a hospital’s low-income patients. The Medicare fraction estimates the hospital’s low-income Medicare patients by determining the percentage of Medicare patients who also received Supplemental Security Income, or SSI, benefits. The fraction looks like this:

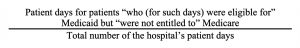

The Medicaid fraction estimates the percentage of a hospital’s low-income Medicaid patients by measuring the percentage of the hospital’s patients who were eligible for Medicaid but not entitled to Medicare. The Medicaid fraction looks like this:

Medicare beneficiaries are excluded from the Medicaid fraction numerator to avoid double counting patients who get both Medicare and Medicaid coverage.

Many aspects of the DSH payment process have been challenged over the last three decades, but the issue in Empire Health is how to interpret the phrases “entitled to” and “eligible for” in the Medicare and Medicaid fractions. The phrase “entitled to” is used when referring to Medicare patients while the phrase “eligible for” is used when referring to Medicaid patients. These phrases have long and jumbled histories, and those histories help muddle attempts to pin down their current meaning.

The strange and tangled history of “entitled to” and “eligible for”

Between 1986 and 2005, HHS changed its interpretation of the phrases “entitled to” and “eligible for” multiple times. Following enactment of the statute that created the Medicare and Medicaid DSH fractions in 1986, HHS interpreted the phrases “entitled to” and “eligible for” narrowly and identically. “Entitled to” and “eligible for” meant only patients whose bills were paid by either Medicare or Medicaid, respectively. HHS justified this interpretation by pointing to a parenthetical phrase — “(for such days)” — in the statutory definition of the two fractions. According to HHS, this parenthetical phrase rendered “entitled to” and “eligible for” identical in meaning.

Thereafter, four federal appeals courts rejected HHS’s narrow interpretation of the phrase “eligible for” in the Medicaid fraction. One of those decisions was Legacy Emanuel Hospital and Health Center v. Shalala, a case that figures prominently in Empire Health. All four appeals courts agreed that the words “eligible for” meant a broader category of Medicaid patients: all patients who qualified for Medicaid, regardless of whether Medicaid paid those patients’ hospital costs. The courts also contrasted Congress’ use of “entitled to” in the Medicare context with “eligible for” in the Medicaid context and concluded that HHS could not treat those different phrases in the same statutory provision as if they were the same.

Thereafter, HHS changed its definition of the phrase “eligible for” Medicaid in a 1997 regulation. HHS expanded the meaning of “eligible for” to include all patients who met the requirements for Medicaid, even if Medicaid did not cover their hospital bills. However, the meaning of the phrase “entitled to” remained unchanged — it still included only patients whose hospital costs were paid by Medicare.

Then, in 2005, HHS issued a new regulation that expanded its definition of “entitled to” to include all patients who qualified for Medicare, regardless of whether Medicare actually paid a patient’s hospital costs. Following the 2005 regulation, “entitled to” and “eligible for” again mean the same thing — but not what they meant before 1997. Now “entitled to” and “eligible for” mean the broader category of patients who qualify for Medicare or Medicaid, respectively, regardless of whether either program paid the hospital bills of those patients.

Challenges to the 2005 regulation

Claiming that HHS’s 2005 regulation underpays them, hospitals brought several challenges to the regulation, with differing results. In 2013, two federal appeals courts upheld the regulation under step two of the Chevron doctrine, noting that while the DSH statute was not clear on the meaning of the phrase “entitled to,” HHS’s new definition was a permissible interpretation of the statute, despite prior court decisions that HHS could not treat “entitled to” and “eligible for” as if they were the same.

In 2020, the U.S. Court of Appeals for the 9th Circuit, in Empire Health Foundation v. Azar, rejected HHS’s 2005 expanded definition of “entitled to,” reasoning that its prior decision in Legacy Emanuel had determined that the definition of “entitled to” was clear, under a Chevron step one analysis. Thus, HHS was bound by the distinction between “entitled to” and “eligible for” established in Legacy Emanuel.

Thereafter, HHS petitioned the Supreme Court to hear the case. The question pending before the justices is whether HHS acted lawfully when it expanded its definition of “entitled to” to include in a hospital’s Medicare fraction all of the hospital’s patients who satisfy the requirements to be entitled to Medicare, regardless of whether Medicare paid the hospital for those patient days. The court’s eventual answer will determine whether certain hospitals can receive substantial government payments under Medicare — payments that, according to one industry group, are “on the order of billions of dollars” when aggregated across the nation’s thousands of DSH hospitals over the entire time the HHS regulation has been in effect.

HHS’s arguments

HHS’s arguments are primarily based on other sections of the Medicare statute which use the phrase “entitled to.” HHS contends that these sections make the Medicare Act’s meaning of “entitled to” clear.

For example, HHS points to various sections of the Medicare Act that distinguish persons “entitled to” Medicare, generally, from persons whose medical services will be covered (i.e., paid) by Medicare. “Entitled to” Medicare is a legal status for individuals who meet specified requirements, such as turning 65. But “entitled to” status does not automatically mean a person’s medical costs will be covered by Medicare. Medicare benefits are typically limited, so there is a chance that someone “entitled to” Medicare may exhaust some benefits. For example, a person could be “entitled to” Medicare, but not covered by Medicare hospitalization benefits because those benefits have been exhausted. Thus, HHS argues, the broader definition of “entitled to” in the 2005 regulation is consistent with other sections of the Medicare Act.

HHS also argues that the approach of the 2005 regulation is supported by Congress’ design of the DSH adjustment, which was structured to sum the percentages of two separate patient populations: low-income patients who are Medicare beneficiaries, and low-income patients who are not (i.e., Medicaid patients). If HHS interpreted the Medicare fraction based on whether a Medicare patient’s hospitalization was covered by Medicare, rather than if a patient was entitled to Medicare generally, patients could shift back and forth between the fractions, depending on whether they had exhausted Medicare coverage. The result would create unnecessary complexities in the DSH calculation and would cut against Congress’ intended framework.

Finally, the agency argues, to the extent the statute does not unambiguously compel HHS’s interpretation, HHS’s is entitled to deference under step two of Chevron as a permissible construction of the statute. Its interpretation is consistent with other parts of the Medicare Act and consistent with congressional intent.

Empire Health’s arguments

Empire Health Foundation, which operates in eastern Washington state, first claims that HHS’s approach in the 2005 regulation systematically — and intentionally — reduces DSH payments to needy hospitals. Along with other hospitals filing amicus briefs, it argues that the regulation is part of a long-standing practice by HHS to habitually flout the intent of Congress when it comes to paying DSH hospitals. As such, HHS should be afforded no deference with respect to its 2005 regulation.

Second, Empire argues that HHS’s position conflicts with the plain language of the DSH statute. HHS treats different phrases in a single statutory provision to mean the same thing, while simultaneously treating the same phrases to mean different things. Here’s how: HHS gives the phrase “entitled to” the same meaning as the different phrase “eligible for” in the same statutory provision. This is a practice that cuts against the most basic rules of statutory construction. Moreover, HHS interprets the phrase “entitled to” differently when it appears twice in the same sentence. The Medicare fraction’s numerator covers patients who are “entitled to” Medicare and “entitled to” SSI. Yet, HHS interprets “entitled to” Medicare to include patients regardless of whether Medicare makes payment, but then interprets “entitled to” SSI later in the sentence to exclude patients without an absolute right to SSI payment.

Third, even if the statute were ambiguous, shifting the analysis to step two of Chevron, HHS’s interpretation is not reasonable, the hospital concludes. HHS both assigns different statutory phrases in a single provision the same meaning while simultaneously giving the same statutory phrase two different meanings in the same sentence. These inconsistent interpretations render HHS’s 2005 regulation unreasonable because they create conflicts within the statute.

* * *

In the end, the Supreme Court will have to sort through a tangled web of interpretive history and conflicting modes of statutory construction to sort out the meaning of the phrase “entitled to.” In doing so, it will likely address the conflicting approaches of the lower courts to HHS’s 2005 regulation. This may give justices hostile to the Chevron doctrine an opportunity to lay down new limits on Chevron. Yet, even if the court confines its decision to the 2005 regulation and leaves Chevron untouched, Empire Health will still have significant fiscal implications for DSH hospitals, whose financial bottom lines will be directly affected by the court’s decision.

Posted in Merits Cases

Cases: Becerra v. Empire Health Foundation