Opinion Analysis

Justices curb securities-fraud class actions, albeit gently

on Jun 22, 2021 at 1:15 pm

The Supreme Court’s Monday decision in Goldman Sachs Group v. Arkansas Teacher Retirement System will not be remembered as one of the court’s seminal securities cases. Indeed, it might not even change the result in the case before it. But it does provide another chapter in the court’s continuing efforts to tighten the standards by which the lower courts evaluate securities-fraud class actions.

The case involves the process by which investors that think they are the victims of securities fraud try to aggregate those claims for class-based adjudication. The focal point of that process is whether common issues of law and fact “predominate,” and a common problem is whether the complaining investors can prove jointly that they relied on the alleged misrepresentations of the defendants. The Supreme Court has an answer for that: Its 1988 decision in Basic Inc. v. Levinson adopted a presumption that plaintiffs relied on statements that affected the price of the security at the time they traded in it. Because those statements affect the price for all investors, they allow common adjudication of the question of reliance. The question in this case is how to proceed when defendants try to rebut that presumption.

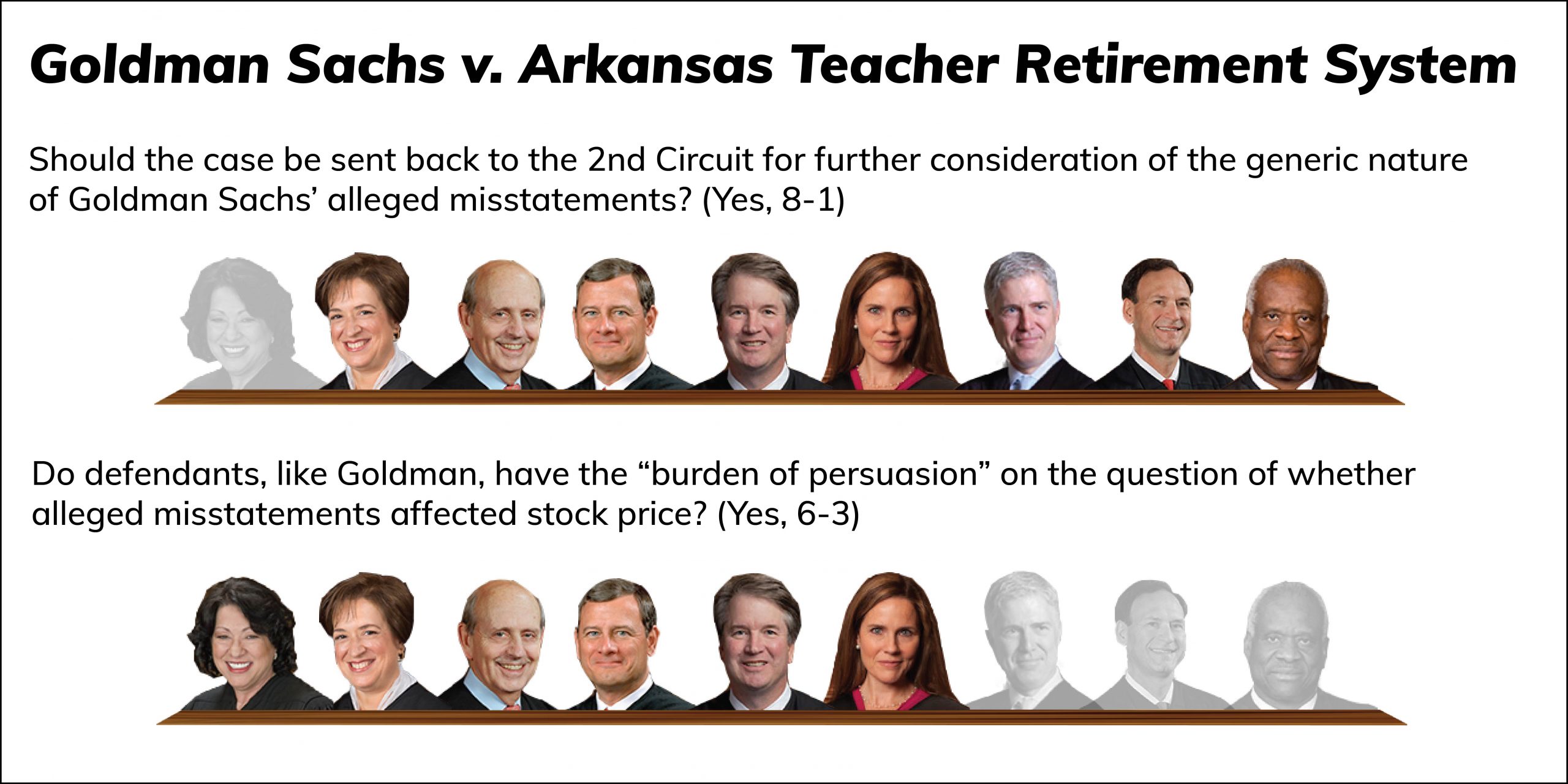

Justice Amy Coney Barrett’s majority opinion resolved three separate questions. First, she reasoned (for a unanimous court) that, when analyzing the Basic presumption, lower courts should consider whether the challenged statements were so generic and nonspecific that they did not distort the price of the security in question. Second (for a majority of eight justices – all but Justice Sonia Sotomayor), Barrett concluded that the likelihood that the U.S. Court of Appeals for the 2nd Circuit failed to do that in this case was sufficient to justify remanding the case for reconsideration. Third (for a majority of six justices), she held that, in order to rebut the presumption of reliance, defendants have the burden of proving that the challenged statements in fact did not affect the price of the securities. Justice Neil Gorsuch dissented on the last point, joined by Justices Clarence Thomas and Samuel Alito.

Although the proper treatment of evidence that generic representations did not affect price was the focus of the briefing and argument, Barrett’s analysis is remarkably succinct: four paragraphs that barely fill two pages. The reason for the brevity is easy to understand: Whatever the parties might have argued in the lower courts, they agreed at the Supreme Court that the generic nature of an alleged misrepresentation can be relevant to the question of whether the misrepresentation affected the price of the security. In light of that agreement, it was clear from the argument that the justices were not likely to order district courts to ignore that evidence. Against that backdrop, Barrett briskly explained (quoting an opinion she’d joined while still on the U.S. Court of Appeals for the 7th Circuit) that courts in this context “should be open to all probative evidence on that question – qualitative as well as quantitative – aided by a good dose of common sense.” In sum, for the justices (none of whom disagreed with this point), “a court cannot conclude that [class adjudication is proper] without considering all evidence relevant to price impact.”

Barrett emphasized that the evidence about the “generic nature of a misrepresentation” will be “particularly” important in so-called inflation-maintenance cases. Those are cases in which plaintiffs do not identify any misrepresentation that raised the price of a stock; they point rather “to a negative disclosure about a company and an associated drop in its stock price; allege that the disclosure corrected an earlier misrepresentation; and then claim that the price drop is equal to the amount of inflation maintained by the earlier misrepresentation.” In such cases, Barrett wrote, the “inference … that the back-end price drop equals front-end inflation … starts to break down when … the earlier misrepresentation is generic (e.g., ‘we have faith in our business model’) and the later corrective disclosure is specific (e.g., ‘our fourth quarter earnings did not meet expectations’).” For her, “it is less likely that the specific disclosure actually corrected the generic misrepresentation, which means that there is less reason to infer front-end price inflation – that is, price impact – from the back-end price drop.”

Having explained why the lower courts should consider information about genericity at the class-certification stage, Barrett then offered a single paragraph vacating the decision of the court of appeals, which upheld the certification of a class of investors who allege that Goldman Sachs inflated its stock price by making false statements that concealed conflicts of interest. She stated simply that the 2nd Circuit’s opinions “leave us with sufficient doubt” about whether that court properly considered the generic nature of Goldman’s alleged misrepresentations, and she sent the case back down for the 2nd Circuit to take another look. That determination (from which Sotomayor dissented) was a little trickier than Barrett suggested, because the 2nd Circuit pretty clearly stated the correct standard in a 2018 opinion the first time it considered the case, though the discussion in its 2020 opinion (the one being reviewed in Monday’s decision) was equivocal at best. Sotomayor would have taken the clear statement from the 2018 opinion as enough to justify affirmance, but none of the other justices agreed with her on that point.

Barrett then turned to the narrow question of identifying which side has the “burden of persuasion” on the question of price impact. All agree that the Basic presumption shifts the “burden of production” to the defendants – the defendants lose if they cannot present any evidence undermining the challenged statements’ presumed impact on price. The question to be answered was, after defendants produce some evidence, who then has the ultimate burden of persuading the court that the statements did, or did not, affect stock price.

Barrett concluded that Basic (and a 2014 decision interpreting Basic called Halliburton v. Erica P. John Fund) had answered that question by assigning to defendants not only the burden to produce evidence to rebut the presumption but also the ultimate “burden of persuasion to prove a lack of price impact.” Barrett pointed to statements in both cases saying that defendants can prevail only by “show[ing]” that the misrepresentation “did not” affect the price. Barrett did not rely entirely on those quotations. She also explained the majority’s view that putting the burden of proof on the plaintiff “would … effectively negate [the court’s ruling in Halliburton] that plaintiffs need not directly prove price impact.” If introduction of “any competent evidence of a lack of price impact” were enough for defendants to defeat the presumption, Barrett wrote, then “the plaintiff would end up with the burden of directly proving price impact in almost every case.” Gorsuch, Thomas and Alito dissented from this holding.

Barrett closed by noting that “the allocation of the burden is unlikely to make much difference on the ground” because it “will have bite only when the court finds the evidence in equipoise – a situation that should rarely arise.” I find that an apt summary of the decision, which similarly might have little bite. If Sotomayor is correct that the 2nd Circuit already considered the generic nature of the misrepresentations here, then it well might have little difficulty in producing yet another opinion authorizing certification of the case for class adjudication.

[Disclosure: Goldstein & Russell, P.C., whose attorneys contribute to SCOTUSblog in various capacities, is counsel for the Arkansas Teacher Retirement System in this case. The author of this article is not affiliated with the firm.]